Stablecoins and the Evolving Payments Landscape in MENA

Paul Joe and Maher Ayari

Plasma, the purpose-built Chain for Stablecoins, sponsored this Research.

Why Stablecoins Matter to MENA

The Middle East and North Africa (MENA) has emerged as one of the world’s most fertile regions for stablecoin adoption. This is driven by.

Remittance Gravity. Gulf Cooperation Council (GCC) economies host over 30 million expatriate workers who send ≈ US$110 billion home each year. Bank wires or cash‐exchange houses cost 5‑8 % and settle in days; a dollar‑pegged stablecoin such as USDT moves in minutes for a few U.S. cents.

Currency Volatility. Egypt, Lebanon, and Turkey have seen double‑digit inflation or outright currency collapses since 2021. Stablecoins provide households with dollar stability without requiring them to hold physical cash or maintain offshore bank accounts.

Mobile‑Native Demographics. Sixty percent of MENA’s 550 million people are under 30; smartphone penetration tops 85 % in the GCC and 75 % in North Africa. A low-friction crypto wallet naturally fits into that lifestyle.

Digital‑Economy Policy. Governments from Abu Dhabi explicitly target cash-light, blockchain-enabled payment rails in their economic diversification plans. Saudi Arabia’s Vision 2030 aims for 70% of all retail transactions to be digital by 2025, making fintech a cornerstone of its economic transformation.

Regulatory Clarity. Bahrain (July 2025) and the UAE (August 2024) now license “payment tokens” that are 1:1 reserve‑backed, audited, and redeemable on demand. Clear rules encourage banks and fintechs to build on-chain rails instead of gray-market workarounds.

Net Result. By mid-2024, stablecoins are expected to account for 52% of all crypto transactions in the MENA region, the highest regional share worldwide.

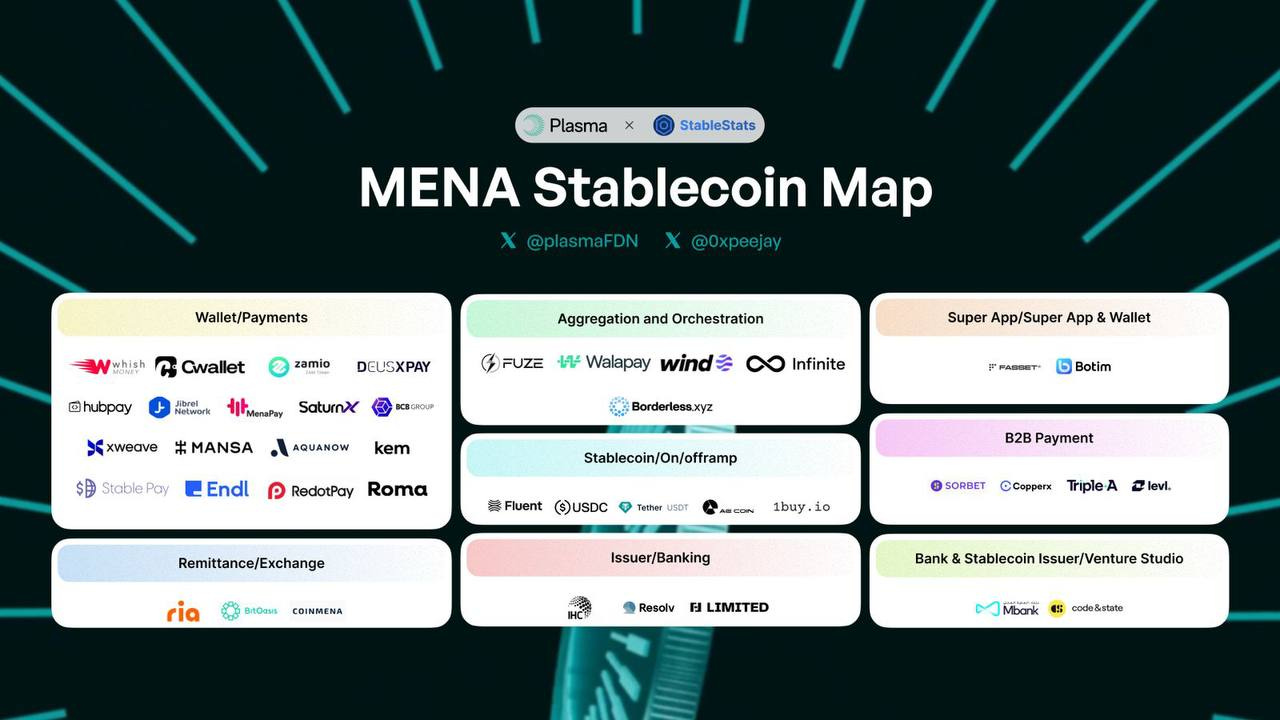

Key Players by Category

Wallets & Super‑Apps

Whish Money (Lebanon) integrates Binance P2P liquidity, allowing users to swap pounds for USDT and remit abroad instantly, which is vital during Lebanon’s banking paralysis.

Botim (UAE), acquired by Astra Tech for US$500 m, has morphed from a VoIP app into a “super‑app” hosting chat, e‑commerce, and an FCA‑style e‑wallet. In May 2025, Botim launched the Jaywan prepaid card with Mbank and Network International, letting unbanked gig workers spend in‑app balances at any POS terminal.

CWallet (Qatar) holds a Qatar Central Bank license to operate payroll and remittance services for migrant labor, settling transactions in USDT while paying out in local fiat or cash.

Sorbet (Saudi Arabia) is building an intuitive, stablecoin-powered neobank for SMBs and individuals in Saudi Arabia and beyond, prioritizing seamless user experience and accessibility. By partnering with Circle and Bridge, businesses can easily manage global payments—whether receiving payments from clients or making payments to contractors—while generating yield on their treasury.

Exchanges & Processors

BitOasis pioneered stablecoin pairs in 2015; it now handles millions of dollars in daily volume, with a focus on GCC on-ramps and compliance.

CoinMENA, licensed by Bahrain’s CBB, offers USDT/USDC trading, along with a merchant plug-in that enabled Bahrain’s first property purchase in USDC.

Hubpay evolved from a remittance wallet into the UAE’s first regulated crypto payment gateway, in partnership with Canadian infrastructure player Aquanow, allowing merchants to accept USDC and settle same-day in dirhams.

Issuers

AE Coin – dirham‑pegged; used since Jan 2025 to pay taxi fares in Abu Dhabi’s Tawasul fleet. “AE Coin is a key pillar of the UAE’s future payment stack,” says Mbank CEO Mohammed Wassim Khayata.

USDZ by Zamzam targets GCC-to-CIS remittances, with quarterly audits published.

USR by Resolv Labs is over-collateralized with crypto and distributes yield; closed a US$10 m seed round (April 2025).

FAB Dirham Stablecoin – announced April 2025; launch expected 2026 pending final central bank approval.

Infrastructure

Fuze supplies white‑label custody + trading APIs, co‐authoring PwC’s 2025 stablecoin report to guide regional banks.

SaturnX (Dubai) and XWeave (Singapore→UAE) raise seed rounds to move high‑volume GCC‑Asia B2B flows off SWIFT and onto stablecoin rails.

Walapay processes over USD 85 million monthly for 40+ fintech clients, abstracting on-chain complexity behind a single API.

Structural Trends

Remittance Dividend

Sending US$200 from Dubai to Manila costs ≈ US$12 via a high‑street exchange but < US$0.20 in network fees via USDT on Tron. Providers like Hubpay and Botim are embedding those savings directly into consumer apps. Circle’s VP of Policy notes, “Costs fall by 90 %, settlement times by 99 % when a remittance operator switches to stablecoins”.

Inclusion & Dollar Safety

Approximately half of North Africans lack access to full bank accounts (World Bank Findex, 2024). In Lebanon’s crisis, street vendors accept USDT at a slight premium over cash dollars because it is easier to source; peer-to-peer trades reportedly top US$25 m weekly (AInvest, 2025). Similar patterns appear in Turkey, where BiLira’s lira‑stablecoin and USDT serve as inflation hedges.

Local‑Currency Tokens & Pilots

The AE Coin taxi pilot demonstrated that consumers are willing to use a domestic stablecoin for micro-payments. Bahrain now allows BHD‑pegged coins; Saudi Arabia is studying a retail riyal token alongside its wholesale CBDC pilot “Project Aber.” Analysts expect at least three new GCC-currency stablecoins to be live by 2026.

Regulation & Institutional Uptake

Bahrain’s July 2025 rulebook requires 1:1 fiat reserves, daily reconciliations, and audited statements; no algorithmic coins are allowed. The UAE similarly bans algorithmic designs, licenses fiat-backed issuers, and has approved USDT and USDC for use in its free zones. Qatar’s 2024 Digital Assets Framework excludes retail crypto trading but hints that fully backed stablecoins could be authorized for the settlement of tokenized assets. Saudi Arabia, Egypt, and Oman are drafting rules encouraged by the Financial Stability Board’s push for cross‑border interoperability standards.

Country Snapshots

UAE

Payment token regulations (CBUAE 2024); AE Coin is now live; FAB and ADQ's dirham coin is in development; USDC/USDT are approved in ADGM/DIFC.

Need harmonized supervision across the mainland and free zones, scaling merchant acceptance.

Bahrain

First dedicated Stablecoin Rulebook (Jul 2025); CoinMENA & Rain licensed; planned BHD coins.

Smaller domestic markets rely on cross-border uptake to scale volumes.

Lebanon

Grassroots USDT usage amid banking collapse: Wish Money, Visa card, and informal cash-to-crypto brokers.

Lack of formal regulation, user protection, and AML gaps.

Qatar

Crypto trading banned; Digital Assets Framework permits tokenization, hinting that stablecoins could be “next.” CWallet licensed.

Conservative stance; awaiting stablecoin-specific rules.

Turkey

Region’s highest crypto volume: BiLira (TRYB) plus massive USDT flows as a lira hedge.

New crypto-asset law under debate; stablecoins are likely to be classified as e-money.

Saudi Arabia

Wholesale CBDC pilot with UAE; sandbox tests of crypto remittances; Vision 2030 urges fintech growth.

Retail stablecoin regulations have not yet been issued; however, there is high potential once they are approved.

Two Mini‑Case Studies

Case A: AE Coin in Abu Dhabi Taxis

Launched in January 2025 by Al Maryah Community Bank, AE Coin (1 AEC = 1 AED) is accepted across 5,000 Tawasul cabs. Passengers scan a QR code in the driver’s app; the settlement posts on a permissioned blockchain, and drivers cash out to their bank at par. Early data indicate that 12% of total fares were paid in AE Coin within six months, a concept that a domestic stablecoin can effectively handle for retail micropayments.

Case B: Botim‑to‑India Corridor

Botim’s 90 million users conduct approximately US$150 million in monthly transfers, 60% of which are bound for India. Behind the chat UI, funds are converted from AED to USDC, then to INR via an on-chain liquidity partner and an RBI-licensed payout switch. Average cost to user: 0.9 % vs. 5.2 % via a high‑street exchange; average delivery time: < 5 min vs. 48 h. Astra Tech reports retention among remittance users is triple that of pure VoIP users.

Funding & Strategic Moves

Astra Tech raised $500 m to build Botim’s super‑app stack, explicitly citing stablecoin rails as the “financial core.”

Resolv Labs secured a US$10 million seed round; SaturnX and XWeave each raised approximately US$3 million to expand their stablecoin B2B networks.

MGX Investments (Abu Dhabi) channeled US$2 bn into Binance’s regional hub, deepening liquidity for GCC stablecoin pairs.

Visa – Wish Money alliance links a Lebanese USDT wallet to 80 million merchant locations, blurring the lines between card and crypto rails.

The FAB + ADQ + IHC consortium exemplifies sovereign, bank, and tech cooperation in issuing a retail stablecoin that could anchor public-sector disbursements and private commerce.

Outlook

Stablecoins are transitioning to infrastructure in the MENA region. Within five years, the area is likely to witness:

Mainstream Retail Use. Domestic barrels of oil purchases, utility bills, and metro fares could be payable in regulated local‑currency stablecoins.

Cross‑Border B2B Default. SMEs may settle invoices in USDT, utilizing treasury tools that auto-hedge FX upon conversion to local fiat.

Bank‑Led Networks. A GCC-wide consortium coin for interbank settlement could rival JPM Coin in terms of volume.

Regulated Diversity. The USD will likely dominate, but expect the dirham, dinar, riyal, and possibly gold-backed tokens to also be in play. The region’s first fully Sharia-compliant, yield-bearing stablecoin is scheduled to be available by 2027.

Policy Convergence. A pan‑GCC “payment‑token passport” would let a license in one state cover all six, mirroring EU e‑money directives.

If regulators continue to strike a balance between innovation and prudence, stablecoins could transform every smartphone in the MENA region into a borderless, 24/7 bank account, catalyzing financial inclusion and fueling the region’s digital economy ambitions.